Tu Hij At Puede Ser Millionari – (Spanish)

$14.99

La infancia es una de las etapas en las que los padres forjan el camino de sus hijos y que mejor momento para que ensee el habito del ahorro a los mas pequeos del hogar sin que esto necesariamente se convierta en una tarea complicada.

De acuerdo con Ordaz Diaz, la transmision de conocimientos en una edad temprana permite evitar problemas a futuro, lo mismo en el caso de temas relacionados con educacion financiera. Existen tres pilares de solidez financiera que le ayudaran a forjar el camino para que sus hijos construyan su futuro financiero basado en el ahorro. El primero tiene que ver con ganar dinero; el segundo con saber administrarlo y el tercero en hacer que crezca el dinero. Se tienen las bases pero, como construir dichos pilares? En el caso del primero, que tiene que ver con ganar dinero, se necesita hablar con los nios todo lo que implica obtener recursos, como hacerlo y ensearle todo sobre dinero.

La construccion del segundo pilar (saber administrarlo) tiene que ver, en gran medida, con las acciones que se establecen en casa, por ejemplo, cuando los padres realizan compras, destinan recursos para el ahorro o un fondo de emergencias o simplemente no cuentan con el habito del ahorro, son seales con las que los nios crecen y en ocasiones replican cuando son adultos. Respecto al tercer pilar, que se relaciona con hacer crecer su dinero, el director de Educacion Financiera en Citibanamex explica que en Mexico el tema de las inversiones aun es un reto ya que “eso generalmente no se ensea”, sin embargo actualmente con herramientas como las Afores o cuentas de Cetesdirecto para nios le permitiran construir a largo plazo una inversion que servira para afrontar momentos de crisis, por ello la importancia de que los padres pongan el ejemplo y acompaen a sus hijos en la construccion de su camino financier.

Childhood is one of the stages in which parents forge the path of their children and what better time to teach the habit of saving to the youngest members of the household without necessarily becoming a complicated task.

According to Ordaz Diaz, the transmission of knowledge at an early age allows avoiding problems in the future, the same in the case of issues related to financial education. There are three pillars of financial strength that will help pave the way for your children to build their financial future based on savings. The first has to do with making money; the second with knowing how to manage it and the third with making money gro

in stock within 3-5 days of online purchase

SKU (ISBN): 9781400245451

ISBN10: 1400245451

Language: Spanish

Juan Diaz

Binding: Trade Paper

Published: April 2023

Publisher: Groupo Nelson

Print On Demand Product

Related products

-

Faith Family And Finances

$19.00America faces high unemployment, huge debt, and a collapsing housing market. Author Henry Fernandez believes that we are facing the consequences of our abandonment of godly standards. You can free yourself from debt and overcome fear by returning to God’s plan for your success. Your faith, finances, and family can have abundance in all areas of your life.

Add to cartin stock within 3-5 days of online purchase

-

How Do I Stop Stressing About Money

$7.99In How Do I Stop Stressing About Money, authors Karen & Ken Gonyer offer 14 principles for managing money and reducing stress, common-sense money-management strategies for couples, tips for teaching children about money, helpful hints for understanding your money-management personality style, and 44 timely tips that can save you thousands of dollars each year. When properly implemented, these stress-reducing money management strategies will have you on the road to financial well-being.

Add to cart2 in stock

-

Managing Gods Money

$9.99Money is often a taboo subject in “polite” society. But did you know that Jesus talked about money more than any subject—including heaven and hell? In this easy-to-follow Q&A version of Money, Possessions & Eternity, Alcorn deals with materialism, stewardship, prosperity theology, debt, and more—and challeges you to rethink your use of God-given resources.

Add to cartin stock within 3-5 days of online purchase

-

Money And Work (Student/Study Guide)

$12.00Getting The Most Out Of Money And Work

1. What Is My Time Worth? Ecclesiastes 3:1-14; 12:1-14

2. Use Or Lose? Matthew 25:14-30

3. Why Work? 2 Thessalonians 3:6-15

4. Trustworthy? Luke 16:1-15

5. What’s Tempting About Power? Matthew 20:1-28

6. How Much Is Enough? Ecclesiastes 5:8-20

7. Does My Property Own Me? Luke 12:13-34

8. How Much Is Too Much? 1 Timothy 6:3-10, 17-20

9. Why Give? 1 Chronicles 29:1-20

10. What If I Lose It All? Job 1:1-22; 19:17-27

Leader’s NotesAdditional Info

Money and work: just the words themselves can cause anxiety. Mortgages, saving for retirement and bottom lines can easily overwhelm us to the point of despair. But God, who “gives us richly all things to enjoy,” wants his people to live in freedom, trusting him and learning to manage our gifts wisely and generously. By pointing to his trustworthiness and generosity, these studies can help you rest in the peace he offers.Add to cart4 in stock (additional units can be purchased)

Worship Music Clef

Worship Music Clef

Blue Skies : How To Live In Extraordinary Expectation Of What's Around The

Blue Skies : How To Live In Extraordinary Expectation Of What's Around The

Esther's Christmas Wish: A Christmas Short Story Play

Esther's Christmas Wish: A Christmas Short Story Play

Be You Tiful Mini Banded Journal

Be You Tiful Mini Banded Journal

101 Best Loved Prayers Box Of Blessings

101 Best Loved Prayers Box Of Blessings

Gift Of Grace

Gift Of Grace

Student Study Bible

Student Study Bible

Spiritual Growth Bible

Spiritual Growth Bible

Beginners Bible Lets Learn About Jesus

Beginners Bible Lets Learn About Jesus

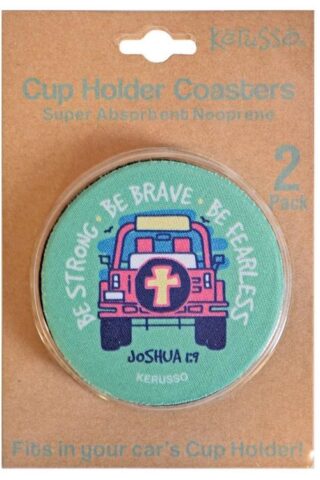

Jeep Coaster

Jeep Coaster

Armor Of God Bible Comfort Print

Armor Of God Bible Comfort Print

Ultimate Guide To Heaven And Hell

Ultimate Guide To Heaven And Hell

Gods Final Call

Gods Final Call

Jesus Vs The Bad Guys

Jesus Vs The Bad Guys

Fierce Love DayBrightener

Fierce Love DayBrightener

Natural Ceramic Framed Tabletop

Natural Ceramic Framed Tabletop

Reviews

There are no reviews yet.