Tu Hij At Puede Ser Millionari – (Spanish)

$14.99

La infancia es una de las etapas en las que los padres forjan el camino de sus hijos y que mejor momento para que ensee el habito del ahorro a los mas pequeos del hogar sin que esto necesariamente se convierta en una tarea complicada.

De acuerdo con Ordaz Diaz, la transmision de conocimientos en una edad temprana permite evitar problemas a futuro, lo mismo en el caso de temas relacionados con educacion financiera. Existen tres pilares de solidez financiera que le ayudaran a forjar el camino para que sus hijos construyan su futuro financiero basado en el ahorro. El primero tiene que ver con ganar dinero; el segundo con saber administrarlo y el tercero en hacer que crezca el dinero. Se tienen las bases pero, como construir dichos pilares? En el caso del primero, que tiene que ver con ganar dinero, se necesita hablar con los nios todo lo que implica obtener recursos, como hacerlo y ensearle todo sobre dinero.

La construccion del segundo pilar (saber administrarlo) tiene que ver, en gran medida, con las acciones que se establecen en casa, por ejemplo, cuando los padres realizan compras, destinan recursos para el ahorro o un fondo de emergencias o simplemente no cuentan con el habito del ahorro, son seales con las que los nios crecen y en ocasiones replican cuando son adultos. Respecto al tercer pilar, que se relaciona con hacer crecer su dinero, el director de Educacion Financiera en Citibanamex explica que en Mexico el tema de las inversiones aun es un reto ya que “eso generalmente no se ensea”, sin embargo actualmente con herramientas como las Afores o cuentas de Cetesdirecto para nios le permitiran construir a largo plazo una inversion que servira para afrontar momentos de crisis, por ello la importancia de que los padres pongan el ejemplo y acompaen a sus hijos en la construccion de su camino financier.

Childhood is one of the stages in which parents forge the path of their children and what better time to teach the habit of saving to the youngest members of the household without necessarily becoming a complicated task.

According to Ordaz Diaz, the transmission of knowledge at an early age allows avoiding problems in the future, the same in the case of issues related to financial education. There are three pillars of financial strength that will help pave the way for your children to build their financial future based on savings. The first has to do with making money; the second with knowing how to manage it and the third with making money gro

in stock within 3-5 days of online purchase

SKU (ISBN): 9781400245451

ISBN10: 1400245451

Language: Spanish

Juan Diaz

Binding: Trade Paper

Published: April 2023

Publisher: Groupo Nelson

Print On Demand Product

Related products

-

Gods Plan For Your Money

$14.99God has a plan for all aspects of your life, including your finances. In this book, Derek Prince reveals how to handle your money according to biblical principles so that you may live in God’s blessing and abundance. Discipleship means discipline, but the disciplined followers of Christ know His heart and see His blessings. Let Derek Prince help you bring your finances in line with God’s perfect plan!

Add to cartin stock within 3-5 days of online purchase

-

You Can Stay Home With Your Kids

$15.99Investing your life in your family brings you joy, and doing it on a single income doesn’t need to stress you out! Join Erin Odom as she shows you how you can live frugally-and thrive-while you raise your kids at home in You Can Stay Home with Your Kids!

From the moment you discovered you were going to be a mom, you envisioned spending each day with your kids, guiding, teaching, and loving them. But diapers, wipes, shoes, and braces are expensive! Though it may feel impossible to manage on one income, Erin Odom from The Humbled Homemaker blog is here to show you that, through God’s grace, staying at home with your kids isn’t just doable; it’s doable while living the good life. Your kids are young only once-you don’t have to miss out just because money is tight.

Erin shares 100 tips, tricks, and simple ways that she has provided the good life on a budget for her family-and you can do the same!

Sections include topics like:

making and sticking to a budget

side income ideas

inexpensive ways to do birthday parties

educational and enrichment activities for little ones that won’t break the bank

date ideas and other ways to connect with your spouse without spending a lot

planning for holidays

and much more!

Experience the freedom, flexibility, and joy that come with being a hands-on mom and spending every day guiding, enjoying, and nurturing your kids, while still providing a lifestyle you can be proud of.Add to cart2 in stock

-

Money And Work (Student/Study Guide)

$12.00Getting The Most Out Of Money And Work

1. What Is My Time Worth? Ecclesiastes 3:1-14; 12:1-14

2. Use Or Lose? Matthew 25:14-30

3. Why Work? 2 Thessalonians 3:6-15

4. Trustworthy? Luke 16:1-15

5. What’s Tempting About Power? Matthew 20:1-28

6. How Much Is Enough? Ecclesiastes 5:8-20

7. Does My Property Own Me? Luke 12:13-34

8. How Much Is Too Much? 1 Timothy 6:3-10, 17-20

9. Why Give? 1 Chronicles 29:1-20

10. What If I Lose It All? Job 1:1-22; 19:17-27

Leader’s NotesAdditional Info

Money and work: just the words themselves can cause anxiety. Mortgages, saving for retirement and bottom lines can easily overwhelm us to the point of despair. But God, who “gives us richly all things to enjoy,” wants his people to live in freedom, trusting him and learning to manage our gifts wisely and generously. By pointing to his trustworthiness and generosity, these studies can help you rest in the peace he offers.Add to cart4 in stock (additional units can be purchased)

-

Smart Money Smart Kids

$24.99Dave Ramsey and Rachel Cruze teach parents how to raise money-smart kids in a debt-filled world. In Smart Money Smart Kids, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze equip parents to teach their children how to win with money. Starting with the basics like working, spending, saving, and giving, and moving into more challenging issues like avoiding debt for life, paying cash for college, and battling discontentment, Dave and Rachel present a no-nonsense, common-sense approach for changing your family tree.

Add to cart1 in stock

Gift And Task

Gift And Task

Peacemakers New Testament With Psalms And Proverbs Pocket Sized Comfort Pri

Peacemakers New Testament With Psalms And Proverbs Pocket Sized Comfort Pri

Jeremiah Study Bible Large Print Edition

Jeremiah Study Bible Large Print Edition

Life Lessons From Mark (Student/Study Guide)

Life Lessons From Mark (Student/Study Guide)

PIGMA Micron 005 Bible Study Pen

PIGMA Micron 005 Bible Study Pen

Face To Face Kids Edition

Face To Face Kids Edition

Sweet Tea For The Soul DayBrightener

Sweet Tea For The Soul DayBrightener

Daniel

Daniel

Growing With God 365 Daily Devos For Boys

Growing With God 365 Daily Devos For Boys

Accu Gel Bible Hi Glider Highlighter 2 Pack

Accu Gel Bible Hi Glider Highlighter 2 Pack

Committee : The Complete 16 Episode Series (DVD)

Committee : The Complete 16 Episode Series (DVD)

Life 100 Day Devotional

Life 100 Day Devotional

Prayer Bible Comfort Print

Prayer Bible Comfort Print

Chronic Illness And Disability

Chronic Illness And Disability

Pinkalicious Pink Around The Rink Level 1

Pinkalicious Pink Around The Rink Level 1

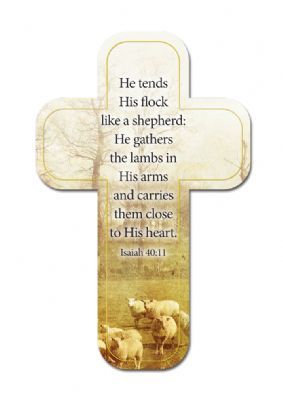

He Tends His Flock Cross Bookmark

He Tends His Flock Cross Bookmark

Prayer

Prayer

Work Of The Deacon And Deaconess (Revised)

Work Of The Deacon And Deaconess (Revised)

Large Print Compact Reference Bible

Large Print Compact Reference Bible

Gold Cross

Gold Cross

Kerusso Kids Rise And Shine (3T (3 years) T-Shirt)

Kerusso Kids Rise And Shine (3T (3 years) T-Shirt)

Worlds Greatest Sermons And Preachers

Worlds Greatest Sermons And Preachers

Kiki Finds Her Voice

Kiki Finds Her Voice

Sharing Jesus With Confidence

Sharing Jesus With Confidence

Saved : Experiencing The Promise Of The Book Of Acts

Saved : Experiencing The Promise Of The Book Of Acts

Mission Possible Bible Study

Mission Possible Bible Study

Threads Of Faith Enamel Cross Braid Cord (Bracelet/Wristband)

Threads Of Faith Enamel Cross Braid Cord (Bracelet/Wristband)

Bondage Breaker : Overcoming Negative Thoughts Irrational Feelings Habitual (Exp

Bondage Breaker : Overcoming Negative Thoughts Irrational Feelings Habitual (Exp

You Count : A Five-Senses Countdown To Calm

You Count : A Five-Senses Countdown To Calm

Developing A Biblical Worldview

Developing A Biblical Worldview

Life Of Jesus Time Line Pamphlet

Life Of Jesus Time Line Pamphlet

How We Got The Bible Participants Guide (Student/Study Guide)

How We Got The Bible Participants Guide (Student/Study Guide)

Church Communications : Methods And Marketing

Church Communications : Methods And Marketing

Grace And Truth Study Bible Large Print Comfort Print

Grace And Truth Study Bible Large Print Comfort Print

Dont Just Teach Reach

Dont Just Teach Reach

From The Rising Of The Sun Morning And Evening Devotional

From The Rising Of The Sun Morning And Evening Devotional

13 Very Amazing Animals And How God Used Them

13 Very Amazing Animals And How God Used Them

Thinline Bible Comfort Print

Thinline Bible Comfort Print

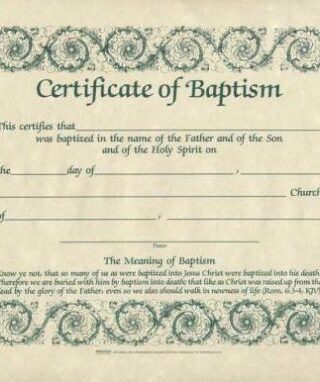

Certificate Of Baptism

Certificate Of Baptism

Large Print Reference Bible Comfort Print

Large Print Reference Bible Comfort Print

Leviticus Chapters 1-14

Leviticus Chapters 1-14

Christmas Promise : Genesis 3; Genesis 12;2; Isaiah 9:6-7; Luke 1:26-38; Lu

Christmas Promise : Genesis 3; Genesis 12;2; Isaiah 9:6-7; Luke 1:26-38; Lu

Parable Of The Prodical Son

Parable Of The Prodical Son

Crucibles That Shape Us

Crucibles That Shape Us

Seasons Of Sorrow

Seasons Of Sorrow

Reviews

There are no reviews yet.