Tu Hij At Puede Ser Millionari – (Spanish)

$14.99

La infancia es una de las etapas en las que los padres forjan el camino de sus hijos y que mejor momento para que ensee el habito del ahorro a los mas pequeos del hogar sin que esto necesariamente se convierta en una tarea complicada.

De acuerdo con Ordaz Diaz, la transmision de conocimientos en una edad temprana permite evitar problemas a futuro, lo mismo en el caso de temas relacionados con educacion financiera. Existen tres pilares de solidez financiera que le ayudaran a forjar el camino para que sus hijos construyan su futuro financiero basado en el ahorro. El primero tiene que ver con ganar dinero; el segundo con saber administrarlo y el tercero en hacer que crezca el dinero. Se tienen las bases pero, como construir dichos pilares? En el caso del primero, que tiene que ver con ganar dinero, se necesita hablar con los nios todo lo que implica obtener recursos, como hacerlo y ensearle todo sobre dinero.

La construccion del segundo pilar (saber administrarlo) tiene que ver, en gran medida, con las acciones que se establecen en casa, por ejemplo, cuando los padres realizan compras, destinan recursos para el ahorro o un fondo de emergencias o simplemente no cuentan con el habito del ahorro, son seales con las que los nios crecen y en ocasiones replican cuando son adultos. Respecto al tercer pilar, que se relaciona con hacer crecer su dinero, el director de Educacion Financiera en Citibanamex explica que en Mexico el tema de las inversiones aun es un reto ya que “eso generalmente no se ensea”, sin embargo actualmente con herramientas como las Afores o cuentas de Cetesdirecto para nios le permitiran construir a largo plazo una inversion que servira para afrontar momentos de crisis, por ello la importancia de que los padres pongan el ejemplo y acompaen a sus hijos en la construccion de su camino financier.

Childhood is one of the stages in which parents forge the path of their children and what better time to teach the habit of saving to the youngest members of the household without necessarily becoming a complicated task.

According to Ordaz Diaz, the transmission of knowledge at an early age allows avoiding problems in the future, the same in the case of issues related to financial education. There are three pillars of financial strength that will help pave the way for your children to build their financial future based on savings. The first has to do with making money; the second with knowing how to manage it and the third with making money gro

in stock within 3-5 days of online purchase

SKU (ISBN): 9781400245451

ISBN10: 1400245451

Language: Spanish

Juan Diaz

Binding: Trade Paper

Published: April 2023

Publisher: Groupo Nelson

Print On Demand Product

Related products

-

How Do I Stop Stressing About Money

$7.99In How Do I Stop Stressing About Money, authors Karen & Ken Gonyer offer 14 principles for managing money and reducing stress, common-sense money-management strategies for couples, tips for teaching children about money, helpful hints for understanding your money-management personality style, and 44 timely tips that can save you thousands of dollars each year. When properly implemented, these stress-reducing money management strategies will have you on the road to financial well-being.

Add to cart2 in stock

-

Keys To Financial Excellence

$20.00Do you struggle week after week just to make ends meet? Do you wish you could give more to God’s work but end up giving the bare minimum? Many people miss the path to true prosperity because they are seeking it through incorrect ideas and false promises. The way to true abundance in all areas of your life is to discover and live in God’s economy. The Bible is filled with hundreds of truths, examples, and principles about how we are to handle our money and our relationships. These scriptural laws and illustrations give us the keys to pleasing God, reflecting His giving nature, and receiving His generous abundance in our lives. Author Phil Pringle has put these biblical truths and illustrations into bite-sized portions that you can grasp easily and apply to your life today. From his personal experience in receiving the overflow of God’s blessings, Pringle show you how to put these dynamic principles into practice. Keys to Financial Excellence is a life-changing treasure that will enable you to experience the fullness of abundant living. Discover a prosperity that will transform your life.

Add to cartin stock within 3-5 days of online purchase

-

Fasting For Financial Breakthrough (Reprinted)

$9.99Shed a spiritual light on some of the biggest problems facing people today: the need to put the role of money in a proper perspective and to solve financial problems. Elmer Towns states at the outset that this is not the primary purpose of fasting and prayer. Instead, it is all about knowing God. It is not about withdrawing prayer on an as-needed basis from some spiritual ATM kiosk. It is about meditation, studying the Scriptures, and communing with God. When we fast and pray in faith, asking for God’s help and provision, He begins to teach us how to become good stewards of what He has provided. Chapter topics include “Fasting to Learn Stewardship,” “Why We Have Money Problems,” and “A Faith Approach to Fasting for Money.” Once we understand why we struggle with money problems, we can do something about it with this practical step-by-step guide.

Add to cart2 in stock

Financial Freedom : How To Manage Your Money Wisely

Financial Freedom : How To Manage Your Money Wisely

Vibes You Feel

Vibes You Feel

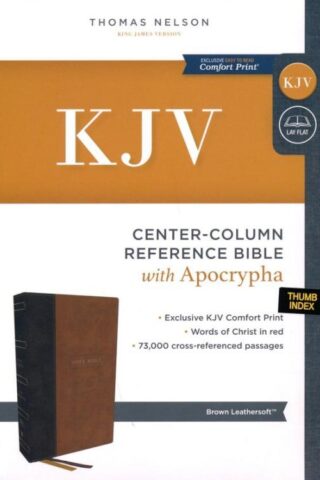

Center Column Reference Bible With Apocrypha Comfort Print

Center Column Reference Bible With Apocrypha Comfort Print

Worry : The Joy Stealer

Worry : The Joy Stealer

Finding Our Way Home

Finding Our Way Home

Thinline Bible

Thinline Bible

Spiritual Growth Bible

Spiritual Growth Bible

Beginners Bible Lets Learn About Jesus

Beginners Bible Lets Learn About Jesus

Jeep Coaster

Jeep Coaster

Armor Of God Bible Comfort Print

Armor Of God Bible Comfort Print

Ultimate Guide To Heaven And Hell

Ultimate Guide To Heaven And Hell

Gods Final Call

Gods Final Call

Jesus Vs The Bad Guys

Jesus Vs The Bad Guys

Fierce Love DayBrightener

Fierce Love DayBrightener

Natural Ceramic Framed Tabletop

Natural Ceramic Framed Tabletop

Reviews

There are no reviews yet.