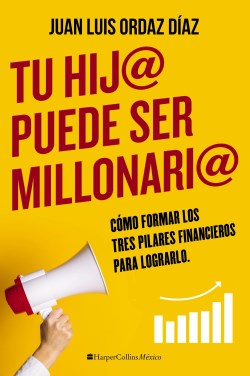

Tu Hij At Puede Ser Millionari – (Spanish)

$14.99

La infancia es una de las etapas en las que los padres forjan el camino de sus hijos y que mejor momento para que ensee el habito del ahorro a los mas pequeos del hogar sin que esto necesariamente se convierta en una tarea complicada.

De acuerdo con Ordaz Diaz, la transmision de conocimientos en una edad temprana permite evitar problemas a futuro, lo mismo en el caso de temas relacionados con educacion financiera. Existen tres pilares de solidez financiera que le ayudaran a forjar el camino para que sus hijos construyan su futuro financiero basado en el ahorro. El primero tiene que ver con ganar dinero; el segundo con saber administrarlo y el tercero en hacer que crezca el dinero. Se tienen las bases pero, como construir dichos pilares? En el caso del primero, que tiene que ver con ganar dinero, se necesita hablar con los nios todo lo que implica obtener recursos, como hacerlo y ensearle todo sobre dinero.

La construccion del segundo pilar (saber administrarlo) tiene que ver, en gran medida, con las acciones que se establecen en casa, por ejemplo, cuando los padres realizan compras, destinan recursos para el ahorro o un fondo de emergencias o simplemente no cuentan con el habito del ahorro, son seales con las que los nios crecen y en ocasiones replican cuando son adultos. Respecto al tercer pilar, que se relaciona con hacer crecer su dinero, el director de Educacion Financiera en Citibanamex explica que en Mexico el tema de las inversiones aun es un reto ya que “eso generalmente no se ensea”, sin embargo actualmente con herramientas como las Afores o cuentas de Cetesdirecto para nios le permitiran construir a largo plazo una inversion que servira para afrontar momentos de crisis, por ello la importancia de que los padres pongan el ejemplo y acompaen a sus hijos en la construccion de su camino financier.

Childhood is one of the stages in which parents forge the path of their children and what better time to teach the habit of saving to the youngest members of the household without necessarily becoming a complicated task.

According to Ordaz Diaz, the transmission of knowledge at an early age allows avoiding problems in the future, the same in the case of issues related to financial education. There are three pillars of financial strength that will help pave the way for your children to build their financial future based on savings. The first has to do with making money; the second with knowing how to manage it and the third with making money gro

in stock within 3-5 days of online purchase

SKU (ISBN): 9781400245451

ISBN10: 1400245451

Language: Spanish

Juan Diaz

Binding: Trade Paper

Published: April 2023

Publisher: Groupo Nelson

Print On Demand Product

Related products

-

Scripture Confessions For Finances

$4.01With today’s busy and demanding schedules, we all need God’s Word wherever we go!

This little book is filled with personalized, Scripture-based confessions for health and healing and for finances. Readers can now arm themselves with the Word of God to win life’s battles.

The Scripture Confessions Series connects the reader to the timeless passages in God’s Word that speak to the issues of most concern to them. More than just a book of prayers, the reader will find personalized confessions that will strengthen them with God’s Word to overcome every adversity.

This unique collection of Scriptures is a must have for readers on the go. Whether at work or home, readers can access Scripture Confessions and remind themselves of God’s faithful promises, in all areas including healing, finances, protection, wisdom, and more!

Add to cartin stock within 3-5 days of online purchase

-

How Do I Stop Stressing About Money

$7.99In How Do I Stop Stressing About Money, authors Karen & Ken Gonyer offer 14 principles for managing money and reducing stress, common-sense money-management strategies for couples, tips for teaching children about money, helpful hints for understanding your money-management personality style, and 44 timely tips that can save you thousands of dollars each year. When properly implemented, these stress-reducing money management strategies will have you on the road to financial well-being.

Add to cart2 in stock

-

What The Bible Says About Money Pamphlet

$4.99Hundreds of Bible passages mention money: its power and its dangers and its blessings. This pamphlet gives ten key biblical principles about money, including (1) God owns everything and has given us many blessings, (2) Everything we have came from the Lord, (3) God holds us responsible for caring for others, (4) Money is not meant to enrich ourselves or to be hoarded but to bring blessings to others, 14 panels, fits inside most Bibles.

Add to cart3 in stock

-

Money Possessions And Eternity (Revised)

$18.99What does the Bible really say about money? This completely revised and updated version of the classic best-seller provides a Christian perspective about money and material possessions based on the author’s painstaking study of the Bible. Randy Alcorn uses the Scriptures to approach this often touchy subject head-on. Thought-provoking arguments challenge readers to rethink their attitudes and use their God-given resources in ways that will have an eternal impact. Alcorn deals straightforwardly with issues of materialism, stewardship, prosperity theology, debt, and more. An excellent choice for group study as well as individual financial guidance. Includes a study guide and appendix with additional resources.

Add to cartin stock within 3-5 days of online purchase

Are You Ready

Are You Ready

Prayer Bible Comfort Print

Prayer Bible Comfort Print

Zacchaeus : Luke 18:35-19:9

Zacchaeus : Luke 18:35-19:9

You Are Mine

You Are Mine

With God All Things Are Possible (Magnet)

With God All Things Are Possible (Magnet)

Simply Jesus : A New Vision Of Who He Was What He Did And Why He Matters

Simply Jesus : A New Vision Of Who He Was What He Did And Why He Matters

Solo

Solo

Distorted Images Of Self (Student/Study Guide)

Distorted Images Of Self (Student/Study Guide)

Thru The Bible Complete Index

Thru The Bible Complete Index

My Grandma (Plaque)

My Grandma (Plaque)

Every Season Sacred

Every Season Sacred

Matthew 11:28-30

Matthew 11:28-30

Perfect Summer : Sometimes You Have To Find The Courage To Make Some Waves (DVD)

Perfect Summer : Sometimes You Have To Find The Courage To Make Some Waves (DVD)

Sacred Strides : The Journey To Belovedness In Work And Rest

Sacred Strides : The Journey To Belovedness In Work And Rest

Who Is God

Who Is God

Prayer : An Adventure With God (Student/Study Guide)

Prayer : An Adventure With God (Student/Study Guide)

Boy From The House Of Bread

Boy From The House Of Bread

Benefit Of Doubt

Benefit Of Doubt

Prayers To Share 100 Pass Along Notes To Share The Love

Prayers To Share 100 Pass Along Notes To Share The Love

Reviews

There are no reviews yet.