Tu Hij At Puede Ser Millionari – (Spanish)

$14.99

La infancia es una de las etapas en las que los padres forjan el camino de sus hijos y que mejor momento para que ensee el habito del ahorro a los mas pequeos del hogar sin que esto necesariamente se convierta en una tarea complicada.

De acuerdo con Ordaz Diaz, la transmision de conocimientos en una edad temprana permite evitar problemas a futuro, lo mismo en el caso de temas relacionados con educacion financiera. Existen tres pilares de solidez financiera que le ayudaran a forjar el camino para que sus hijos construyan su futuro financiero basado en el ahorro. El primero tiene que ver con ganar dinero; el segundo con saber administrarlo y el tercero en hacer que crezca el dinero. Se tienen las bases pero, como construir dichos pilares? En el caso del primero, que tiene que ver con ganar dinero, se necesita hablar con los nios todo lo que implica obtener recursos, como hacerlo y ensearle todo sobre dinero.

La construccion del segundo pilar (saber administrarlo) tiene que ver, en gran medida, con las acciones que se establecen en casa, por ejemplo, cuando los padres realizan compras, destinan recursos para el ahorro o un fondo de emergencias o simplemente no cuentan con el habito del ahorro, son seales con las que los nios crecen y en ocasiones replican cuando son adultos. Respecto al tercer pilar, que se relaciona con hacer crecer su dinero, el director de Educacion Financiera en Citibanamex explica que en Mexico el tema de las inversiones aun es un reto ya que “eso generalmente no se ensea”, sin embargo actualmente con herramientas como las Afores o cuentas de Cetesdirecto para nios le permitiran construir a largo plazo una inversion que servira para afrontar momentos de crisis, por ello la importancia de que los padres pongan el ejemplo y acompaen a sus hijos en la construccion de su camino financier.

Childhood is one of the stages in which parents forge the path of their children and what better time to teach the habit of saving to the youngest members of the household without necessarily becoming a complicated task.

According to Ordaz Diaz, the transmission of knowledge at an early age allows avoiding problems in the future, the same in the case of issues related to financial education. There are three pillars of financial strength that will help pave the way for your children to build their financial future based on savings. The first has to do with making money; the second with knowing how to manage it and the third with making money gro

in stock within 3-5 days of online purchase

SKU (ISBN): 9781400245451

ISBN10: 1400245451

Language: Spanish

Juan Diaz

Binding: Trade Paper

Published: April 2023

Publisher: Groupo Nelson

Print On Demand Product

Related products

-

Gods Plan For Your Money

$14.99God has a plan for all aspects of your life, including your finances. In this book, Derek Prince reveals how to handle your money according to biblical principles so that you may live in God’s blessing and abundance. Discipleship means discipline, but the disciplined followers of Christ know His heart and see His blessings. Let Derek Prince help you bring your finances in line with God’s perfect plan!

Add to cartin stock within 3-5 days of online purchase

-

Why The Tithe

$5.49The offering of tithes that Abraham gave to Melchizedek was an act of homage, reverence, love, and faith.

When we bring our tithes to our High Priest, we are saying “I love You. I bow my knee to You. I bow my will to You. I gladly give my life to You.”

Tithing is an eternal principle. It is a grace gift. It is God’s way of building strong, healthy, and happy people for His glory.

Add to cartin stock within 3-5 days of online purchase

-

Smart Money Smart Kids

$24.99Dave Ramsey and Rachel Cruze teach parents how to raise money-smart kids in a debt-filled world. In Smart Money Smart Kids, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze equip parents to teach their children how to win with money. Starting with the basics like working, spending, saving, and giving, and moving into more challenging issues like avoiding debt for life, paying cash for college, and battling discontentment, Dave and Rachel present a no-nonsense, common-sense approach for changing your family tree.

Add to cart1 in stock

-

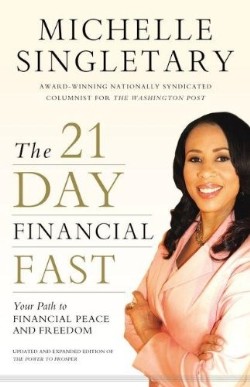

21 Day Financial Fast

$16.99In The 21-Day Financial Fast, award-winning writer and Washington Post columnist Michelle Singletary has a field-tested financial challenge for you. For twenty-one days, you will put away your credit cards and buy only what you need to survive. With Michelle’s guidance during this three-week financial fast, you’ll discover how to:

*Break bad spending habits

*Plot a course to become debt-free with the Debt Dash Plan

*Avoid the temptation of overspending for college

*Learn how to prepare their elderly relatives and themselves for future long-term care expenses

*Be prepared for any contingency with a Life Happens Fund

*Stop worrying about money and find the priceless power of financial peaceAs you discover practical ways to achieve financial freedom, you’ll experience something even more amazing—your faith and generosity will increase as well.

Add to cart1 in stock (additional units can be purchased)

Every Womans Bible Filament Enabled Edition

Every Womans Bible Filament Enabled Edition

God Rescues Us: Psalms 42–72

God Rescues Us: Psalms 42–72

Hi God Its Me

Hi God Its Me

Rabbit Has A Party

Rabbit Has A Party

End The Stalemate

End The Stalemate

Age Of AI

Age Of AI

Authentic Influencer : The Barnabas Way Of Shaping Lives For Jesus

Authentic Influencer : The Barnabas Way Of Shaping Lives For Jesus

Clarity Of Mind

Clarity Of Mind

David And Goliath (Action Figure)

David And Goliath (Action Figure)

Frequency DayBrightener

Frequency DayBrightener

Babys First Hannah The Praying Doll

Babys First Hannah The Praying Doll

CrossWise Quarterly (Student/Spring 2025)

CrossWise Quarterly (Student/Spring 2025)

Old Testament Wisdom And Poetry

Old Testament Wisdom And Poetry

Global Folk Bible Tabs

Global Folk Bible Tabs

Student Life Application Study Bible Filament Enabled Edition

Student Life Application Study Bible Filament Enabled Edition

Thinline Center Column Reference Bible Filament Enabled Edition

Thinline Center Column Reference Bible Filament Enabled Edition

Compact Reference Bible

Compact Reference Bible

How Great The Glory Of Our God Anthem (Printed/Sheet Music)

How Great The Glory Of Our God Anthem (Printed/Sheet Music)

Miracle Of You

Miracle Of You

Life Of Paul

Life Of Paul

Always And Forever Guestbook

Always And Forever Guestbook

NET Timeless Truths Bible Comfort Print:

NET Timeless Truths Bible Comfort Print:

Sexual Integrity : Balancing Your Passion With Purity

Sexual Integrity : Balancing Your Passion With Purity

Bible Hi Glider Accu Gel Highlighter

Bible Hi Glider Accu Gel Highlighter

Tribal Cross Faith Gear Canvas (Bracelet/Wristband)

Tribal Cross Faith Gear Canvas (Bracelet/Wristband)

1 Year Bible

1 Year Bible

Teen Study Bible Comfort Print

Teen Study Bible Comfort Print

Luke In The Land Bible Study Book With Video Access (Student/Study Guide)

Luke In The Land Bible Study Book With Video Access (Student/Study Guide)

Cowboy Bible Verses DayBrightener

Cowboy Bible Verses DayBrightener

Classic Christmas Caroling Songbook : 30 Sing Along Favorites (Printed/Sheet Mus

Classic Christmas Caroling Songbook : 30 Sing Along Favorites (Printed/Sheet Mus

Celebrating the Holiness of God: Psalms 73–89

Celebrating the Holiness of God: Psalms 73–89

Peach Floral Guestbook

Peach Floral Guestbook

Fierce Love DayBrightener

Fierce Love DayBrightener

Take You To The Cross Anthem (Printed/Sheet Music)

Take You To The Cross Anthem (Printed/Sheet Music)

Majestic Bible Tabs Foil Edged

Majestic Bible Tabs Foil Edged

Genuine Leather Plain

Genuine Leather Plain

Life Together : The Classic Exploration Of Christian Community

Life Together : The Classic Exploration Of Christian Community

Mr And Mrs Our Wedding LuxLeather

Mr And Mrs Our Wedding LuxLeather

Large Print Personal Size Reference Bible

Large Print Personal Size Reference Bible

Beyond The White Picket Fence

Beyond The White Picket Fence

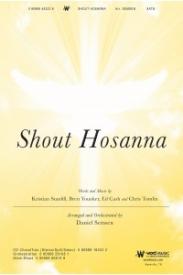

Shout Hosanna Anthem (Printed/Sheet Music)

Shout Hosanna Anthem (Printed/Sheet Music)

Give Thanks Gratitude Jar With Cards

Give Thanks Gratitude Jar With Cards

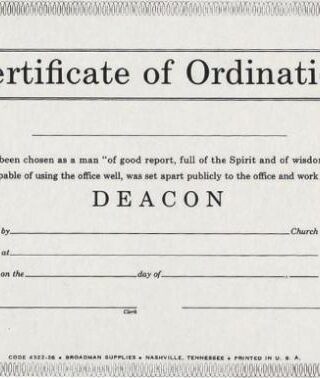

Certificate Of Ordination Deacon Billfold

Certificate Of Ordination Deacon Billfold

Tri Fold Bible Cover Organizer

Tri Fold Bible Cover Organizer

Great Disappearance Bible Study Guide (Student/Study Guide)

Great Disappearance Bible Study Guide (Student/Study Guide)

Thinking Of You Bible Letters

Thinking Of You Bible Letters

Beatitudes Bookmarks

Beatitudes Bookmarks

Our Little Buddy Nightlight

Our Little Buddy Nightlight

Surprised By Hope

Surprised By Hope

Halleys Study Bible Comfort Print

Halleys Study Bible Comfort Print

You Can Stay Home With Your Kids

You Can Stay Home With Your Kids

Personal Size Reference Bible Sovereign Collection Comfort Print

Personal Size Reference Bible Sovereign Collection Comfort Print

Rooster Collection Wooden Set

Rooster Collection Wooden Set

Reviews

There are no reviews yet.